2 Customer Acquisition Graphs For Your Digital Dashboard

/ TweetSurvey data released in the last week points to a recent rise in the importance of email as a customer acquisition channel for the retail industry.

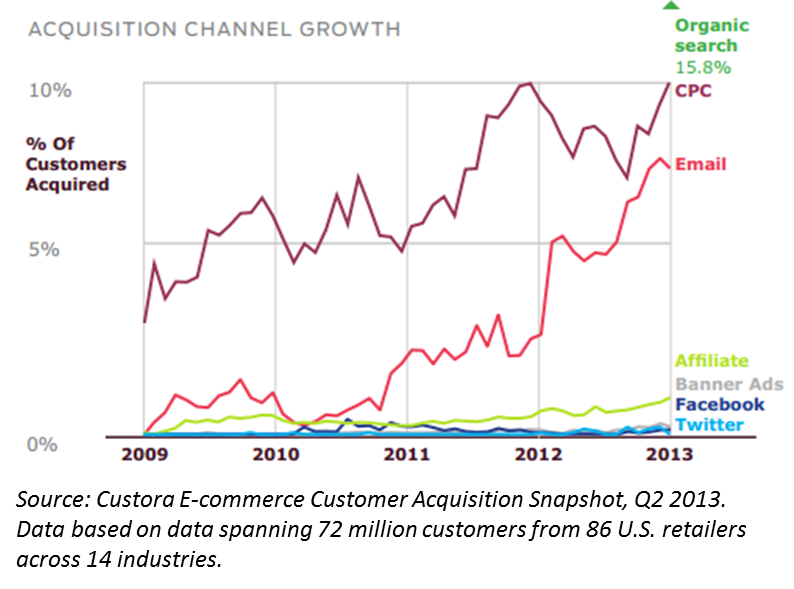

It’s a provocative finding given that email tends to be the Rodney Dangerfield of digital marketing work, with marketers over the last few years giving much more attention to flashy social media tactics. And yet, see how organic search (whose value is off the chart created by the Custora E-commerce Customer Acquisition Snapshot) and email lead as acquisition sources for retailers.

Email's Impact Doubled

At a time when few of us were giving any respect to email, its impact more than doubled, providing almost 7% of customers in 2013 compared to less than 3% in 2011. By contrast, banner ads, Facebook and Twitter crawl along the bottom of the chart.

The breakdown of lead sources may be different from how asset managers have acquired customers over the last few years—you may want to include Online Event Marketing and would probably drop Affiliates, for example—although I suspect they’re directionally consistent. I also agree with the commenters to the post who point out that social activities may not be getting credit for creating awareness that eventually leads prospects to subscribe to emails.

Whether in the retail or the asset management industry, once a subscriber is on board, email can be a powerful brand-builder and prospect nurturer.

2 Questions

But the purpose of this post is less about the data and more about the exercise. I’ll use the survey as the occasion to pose two questions to you:

1. Are you tracking and comparing the sources of names that you acquire that eventually turn into customers? Your dashboard should include a graph of customer acquisition by channel over time, too.

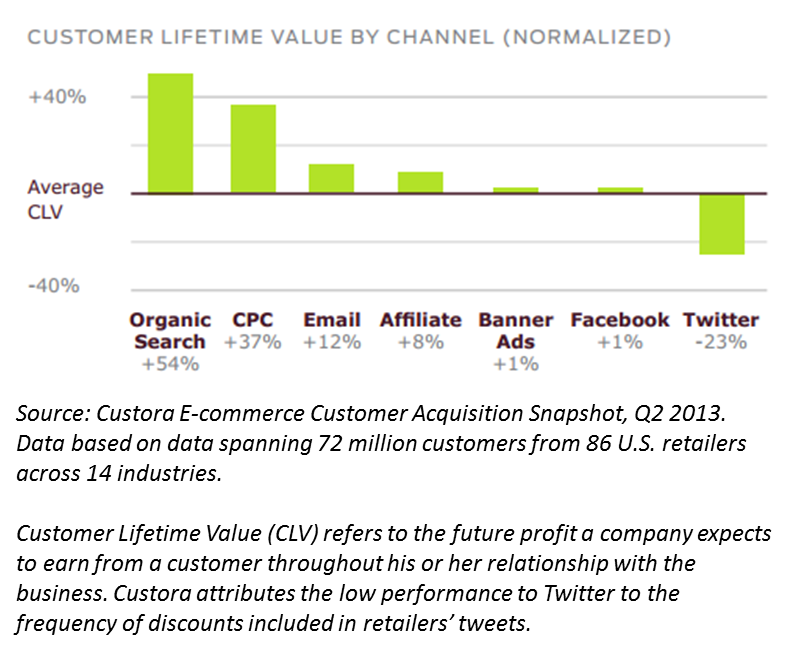

2. Are you also tracking the value of the names acquired by channel and comparing them to a computed average customer lifetime value a la this Custora graph?

Of course, attribution (i.e., in most cases, the source of the last click is the channel credited for sourcing the prospect) is a consideration to work through. But for starters, make sure that you’re collecting and organizing channel and customer value data in a way that lends itself to further analysis.

Of course, attribution (i.e., in most cases, the source of the last click is the channel credited for sourcing the prospect) is a consideration to work through. But for starters, make sure that you’re collecting and organizing channel and customer value data in a way that lends itself to further analysis.

Speaking of flash, here’s to a fireworks-filled but safe Independence Day! See you back here or on Twitter next week.