2013: Time To Show Some Personality (And All That Implies)

/ TweetIn my experience, it’s impossible to have a conversation with an asset management firm interested in social media without talking about PIMCO and Bill Gross. The discussion can be challenging. The PIMCO and Bill Gross mastery of social media is atypical, and should not be the basis on which most firms set their expectations and make their plans.

PIMCO’s dominance is on Twitter, the social platform that makes the most sense for thought leadership-producing investment companies. But unlike what's usually required to be successful on Twitter, there is no conversation in the give-and-take sense. @PIMCO follows exactly one account (@PIMCOFoundation). The account never re-tweets, let alone acknowledges others’ tweets.

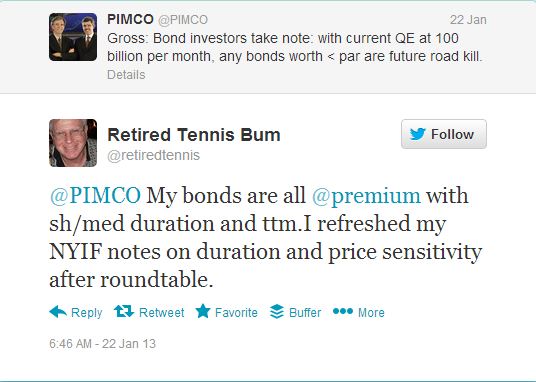

Despite this, people are so drawn to the brand that tweets like this back to Gross are not uncommon. Impressive.

But here’s where PIMCO is setting an example that can and should be followed by asset managers. On Twitter, people and their natural language represent the PIMCO brand. PIMCO even foregoes its logo, preferring to use a photo of Bill Gross and Mohamed el-Erian together as its avatar.

What’s more, the legendary bond king writes his own tweets. "Very cool to know Gross pens his own tweets!" Morningstar Advisor Publisher Leslie Marshall tweeted while attending yesterday's ETF Virtual Summit, where Gross was the keynote presenter.

Gross gets lots of attention for the PIMCO tweets but I have never believed that he wrote his own tweets (not even for this exchange). In fact, at times I've thought that I detected a change in the writing style, which I attributed to a stable of ghost-tweeters. But after I saw Leslie’s tweet this morning, I went to PIMCO PR and asked for confirmation once and for all.

“Confirmed…he writes every word” was the response.

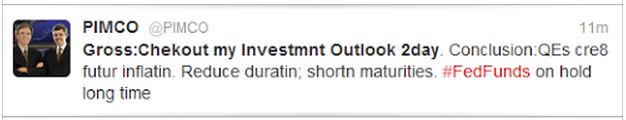

“Even this one?” I asked, pasting in the following tweet I’d saved from last May (I know, I need to get a life and I promise I will. If not this year, next year for sure).

There isn’t a communications professional working in the industry today that would allow this SMS-inspired, truncated message to fly, if not written under Bill Gross's name and delivered via Twitter. Substance and timeliness trump form and formality. All hail.

And now back to the challenge facing the rest of us mere mortals.

Toward A Social Business

It’s easy for individuals to be effective using social media, while it can be difficult for brands. It’s more of a struggle for business-to-business brands than for business-to-consumer brands, and it can be a whole lot of complicated for regulated investment business-to-business brands unaccustomed to projecting a personality in public.

A social presence needs a voice in order to engage and be engaged. That's one of the advantages that @PIMCO has. Gross has a personality that's evident across every communications platform he uses, but Twitter is where he seems freshest and most accessible. (Read this for a contrary view.)

Maybe PIMCO-like attention isn't available to every firm. But by now the path to becoming a business whose social participation deepens relationships and fosters collaboration is well worn and documented. (The IBM CEO Study: Command & Control Meets Collaboration published last year is a must-read if you haven't yet).

Few firms can get what they want (i.e., the benefits of a social business) while retaining an institutional persona.

To date, the almost $60 trillion investment management industry is personified by a handful of faces on social networks. There are the Twitter accounts of investment strategists, mostly, and CEOs shown below (the image is linked to the Rock The Boat Marketing Twitter list of Investment Managers, which all are included on). Vanguard CEO Bill McNabb takes to Facebook and Twitter periodically. Not all of these are communicating as their natural (male, notice) selves.

More asset manager employees are active in LinkedIn groups, but it tends to be passive participation in private groups. With no real conversation stream, there's plenty of time to submit a measured, corporate comment.

The personality that's being shown on asset manager blogs is indeed a positive sign, but publishing and moderating posts on one's own domain is different from participating on a social platform.

I'm predicting that 2013 may ring in a change. This just may be the year when we begin to see "extemporaneous," natural communicating and insights from real live people in responsible positions at asset management firms. It's not just wishful thinking on my part. I've been wishing for it since at least the May 2010 flash crash; this year I think it could happen. I'm seeing signs that the business imperative (and opportunity) is dawning on asset managers, who have needed time to get organized.

Look for more investment strategists—how cool would it be to observe a few strategists engaging one another on a forum like Twitter—more firm execs, at least one sales leader, maybe some value-added program managers. National account people or wholesalers? Maybe. This industry will never rival Microsoft or Zappos in social participation but neither will participation remain at the current level for much longer.

If your work involves prepping your firm’s marquee names, encourage them to do it themselves, using their own words and in real-time. Oh, it’s going to be fun, running interference between all the many interests (Compliance, Legal, Brand, Investments, Sales) that prefer a more programmed approach. This will require your best, most thoughtful work, if you expect to help the firm gain in relevance in even a fraction of the way that PIMCO has.

By the way, who will be the first asset management CMO to take to Twitter with a public account?