Advisors And Social Media, Infographics, Logowear, Syndication, Wholesaling: What You Might Have Missed

/ TweetWelcome back to all you asset management digital marketers out on spring break last week! Here’s hoping your re-entry is easy and crisis-free.

To help you catch up, here’s a briefing on five items that you may have missed if you spent last week at a theme park.

#1 Social Media And Financial Advisors’ Immediate Plans

Another week, another survey that touches on financial advisors and social media. Given the attention I paid here and on the AdvisorTweets blog to the American Century survey, I'm honor-bound to call your attention to the Rydex|SGI AdvisorBenchmarking Advisor Confidence Index survey results.

Advisor confidence sank again in March, according to the headline of the research released Tuesday. But tucked in at the end of the press release was Rydex finding that “Most advisors—59%—have no plans to include social media as part of their practices in the next 12 months.” That report based on the sentiments of 150 independent registered investment advisors (RIAs) paints a less imminent adoption rate than has been suggested by the recent American Century or kasina research.

#2 Asset Manager Infographics

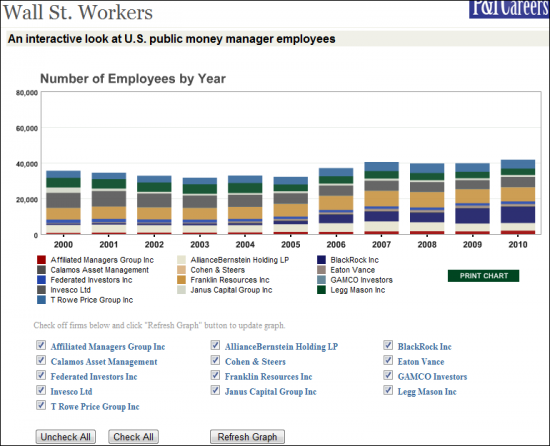

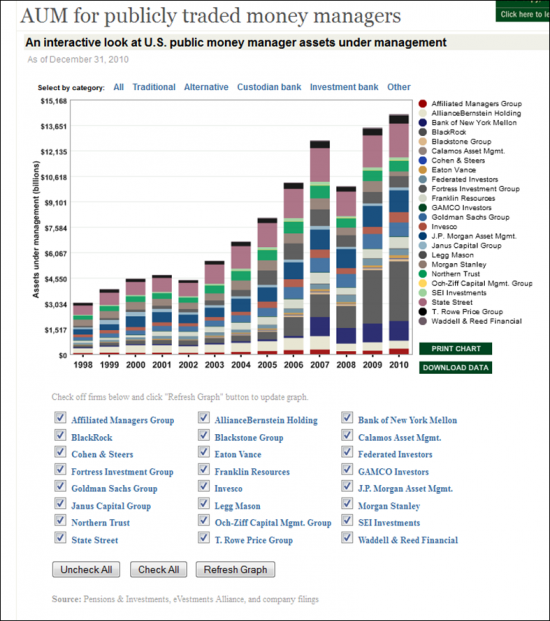

I don’t know when these infographics were first published but I learned about the Pensions & Investments chart depicting the growth of employees at U.S. public money managers from an @everydtenacity tweet Friday. After looking around PIonline.com, I spotted the asset manager growth in assets under management (AUM) graph. These screenshots don’t do them justice—you really have to go to the site and interact with the graphs—look at just one firm or select your own to compare.

These charts don’t represent any added transparency on the part of asset management firms. Rather, they visualize data contained in public filings.

Publishers are committing resources to infographic development because infographics engage readers, and their interactivity may extend time spent on a site, which helps online advertisers looking for exposure.

We’re crazy about infographics for this business because of their ability to add meaning to those rows of data tables that mutual fund and exchange-traded fund (ETF) firms routinely publish (see our Visualization-related posts). As we’ve commented a few times, creating content that people value and like to share is increasingly important. Also, see #4 below.

#3 Logo Items Mentioned In The Context of Impropriety?

Asset manager marketing budgets aren’t public, but wouldn’t you love to see an infographic comparing changes in the composition of various asset managers' marketing budgets? I thought of that while reading Saturday’s Wall Street JournalIntelligent Investor column about insider trading. The Jason Zweig article was inspired by the disclosure that a Berkshire Hathaway executive bought nearly $10 million worth of stock in a company (Lubrizol) about a week before he suggested that Berkshire acquire the company.

Most people, Zweig reported, have what’s called an ethical blind spot. “Faced with a potential conflict of interest, you automatically conclude that it couldn't possibly offer any temptation to someone of superior character—like you or those closest to you.”

Zweig provided several examples: doctors that accept high-paying consultancies from a pharmaceutical firm and don’t believe it skews their judgments about which medications to prescribe, Wall Street analysts who accept favors from the companies they follow and… “financial advisers accepting trinkets like tote bags and T-shirts from fund companies.”

This is a step beyond digital marketing but your budget rolls up to an overall Marketing budget, right? And is there a line item for promotional logo items that appears hard-coded in the budget worksheet year after year, even despite many firms’ heightened focus on the RIA channel?

Zweig’s inclusion of financial advisor swag in his analysis of improprieties in the investment business is another sign that the winds have shifted away from investment company-branded windbreakers. Increasingly, independent-minded advisors are sensitive to anything that causes them to appear as investment product shills. Maybe this mention can serve as the prompt your team needs to review how much you’re spending on logowear, its alignment with your business strategy and whether your clients value it.

#4 OppenheimerFunds’ Content Syndication Play

BtoB magazine rarely covers this business so it was good to see last Wednesday’s interview with OppenheimerFunds’ CMO Martha “Marty” Willis. Willis described how advertising is being used to drive financial advisors to a microsite offering “’snackable’” pieces of content that advisors can send on to their end-customers.”

“Sharing—syndication of this material—is big; and we're hoping advisers will put these on their sites. The idea is graphical, how to enable people to more easily digest this material. We think there is long-term opportunity here,” said Willis.

You’ll want to check out the materials available on the GlobalizeYourThinking microsite and Oppenheimer's YouTube channel. It had looked to me as if the video-sharing capability was limited to enabling advisors to email links to clients but I see that embed code is offered on the YouTube channel.

Looking at both the demand side tracked in part by the social media research and at the supply side, we are still very early in money managers creating content they hope advisors will want to share.

To understand what’s resonating and what isn’t, you’re going to need to spend more time on advisors’ Websites and blogs. Remember that you can use AdvisorTweets.com as a real-time window to the online content that advisors are creating and the content they’re exchanging. If you know what you’re looking for, the AdvisorTweets’ search engine may come in handy.

#5 Wholesaling Illuminated

Mutual fund/ETF wholesaling has been a fairly arcane activity. Do you know about I Carry The Bag, “the first and only magazine dedicated to the Art, Science, and Lifestyle of wholesaling,” WholesalerMasterminds.com and the 1,100-plus memberWholesaler Masterminds LinkedIn Group?

I’ve been watching this effort by Rob Shore, a former wholesaler, sales leader and now coach, because he’s using the Web to shed light on wholesaler practices and stimulate discussions. It’s interesting for marketers who seek to develop a broader understanding of how business gets done.

On Wednesday Shore published this podcast interview with Craig Rollins, a financial advisor who wroteThe Wholesaler’s Companion. It's a book on wholesaling from the client side of the table as inspired by Rollins' experience with wholesalers. “5 Ways Wholesalers Endear Themselves to Advisors for Life” doesn’t contain any groundbreaking insights but it’s worth your nine minutes.