Fun With Mutual Fund, ETF Website Traffic Data

/ TweetThe next time you have an hour or two—sooner if you just can’t resist—check out the mutual fund and exchange-traded fund (ETF) sites in the investing and financial management categories of SimilarWeb.com, which reports on Website traffic. There’s a free version, which will keep you more than occupied, and a few paid subscription levels.

The individual profiles help with competitive intel about traffic levels and traffic sources, including search and social (organic and paid). Taken in aggregate, they provide a fascinating perspective on how sites are networked on the Web. Also, it’s motivating, isn’t it, to think of all of these investors in search of information?

About The Data

Like Comscore and Nielsen, among others, the data that SimilarWeb reports is based on panels of participants. SimilarWeb claims to be “several times bigger than traditional panels. This allows us to learn about every Website, big and small, and overcome the statistical errors that are typical of smaller panels.”

However, SimilarWeb’s data is of desktop traffic exclusively, and therefore not comprehensive. Mobile visits are an increasingly significant chunk of asset manager site traffic.

If you use just the free access of SimilarWeb, take note that sub-domains of Websites are reported individually. Because many asset managers rely on multiple sub-domains or maintain separate domains, the rankings will under-report the effectiveness of a competitor online. And, it can be tricky to assess traffic out of context.

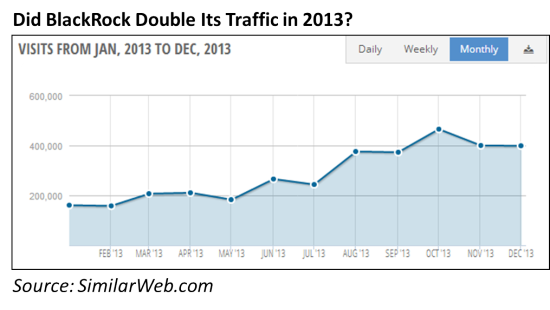

For example, BlackRock.com looks to have doubled its traffic in 2013. Is that the result of a very good year or is there another explanation—e.g., a consolidation of domains, for example?

The paid version of SimilarWeb allows for the selection of either All domains and Main domain. In the comparisons I cite below, I looked at All domains.

There seems to be a lot of movement in the top 100 rankings. I reviewed the data as of November 30 and as of December 31, and the composition of the list changed more than just a few positions.

Here’s a random list of what I found interesting about traffic to investing sites in general and to the industry’s most-trafficked sites. I’ve restricted myself to quoting only data that can be viewed for free on the site.

The More Things Change, The More They Stay The Same

First, how about some respect for the granddaddy and still number 1 among investing Websites: YahooFinance.com?

SimilarWeb says the site attracted almost 2 billion visits in 2013, 150 million in December alone. Yahoo Finance stays on top the old-school way—63% of its traffic comes from links from other sites, towering over search, social or even direct as a traffic source.

No asset management site whose data I reviewed comes anywhere close to that, and yet referrals can be an enduring source of traffic.

The New And The Odd

Quite a few new and new business-model sites have broken into SimilarWeb’s top 100 in the U.S. investing category. For example, Twitter skeptics, note that StockTwits ranked #15 in December. Two-year-old Wealthfront, “the largest and fastest-growing SEC-registered, software-based financial advisor,” breaks in at #94 on the list.

Does anyone else find it odd that of all the possible investing sites out there (including yours) FINRA.org comes in at #42? CFAs make CFAInstitute.org crazy popular (#63).

2013 Traffic Stable Or Climbing

The syndication of content and the popularity of social platforms together call the question: What's the future of corporate domains? When I last wrote about this topic in 2009, I cited asset management Website data that pointed to declining usage and traffic.

But the 2013 12-month view of traffic—visits and not visitors—available from SimilarWeb suggests that traffic to most sites has been stable, if not climbing.

Fidelity And Vanguard

Traffic to Vanguard.com ranks it as the first mutual fund/ETF site in the U.S. investing category—separated by about 2 million visits from TRowePrice.com, the next highest mutual fund/ETF site on the list.

Fidelity’s nearly 16 million visits trump all, but is categorized in SimilarWeb’s “financial management” category.

Winning Search Traffic

It appears that even the best trafficked sites could do much better at winning search traffic. This is lamentable given all the content available on asset management sites (and tons in the making). Most sites fail to significantly benefit from search results for search terms other than derivatives of their brand names.

Here’s an exception worth noting: In 2013 about 4% of Fidelity’s enormous traffic came from the search term: 401k. Impressive—and, of course, it helps that 401k.com redirects to a Fidelity domain.

Also, a few ETF providers are gaining hearty traffic from searches of their ticker symbols, albeit another form of branded search. Promoting their longer ticker symbols is something mutual funds have not tended to do.

A Few Social Surprises

Speaking from experience, one could lose oneself in the detail that SimilarWeb provides about social traffic.

The paid version reports the total number of socially sourced visits for the year and by that measure, Vanguard was the most effective social asset manager in 2013. But BlackRock came on strong in the fourth quarter. As can be seen reported on the free SimilarWeb, 12% of BlackRock’s estimated 400,000 monthly visits is 50,000 visits. From Social alone.

There are a few surprises in the composition of the social traffic. For BlackRock, YouTube was the major contributor. For Fidelity, it was Facebook.

But Vanguard’s top social driver was Reddit aka "the front page of the Internet." Reddit has been a strong source of traffic to more consumer-type sites (although reportedly less so in 2013 than in 2012). Vanguard, and Fidelity to a lesser extent, got a sizable amount of referrals from the platform in 2013. Reddit traffic drove visits to PIMCO, iShares, even American Funds last year.

What SimilarWeb can't tell us is the quality of the traffic or how successful the firms were in converting it.

What about Twitter and LinkedIn? According to the SimilarWeb data, Twitter is driving more traffic than LinkedIn but both are just runner-ups.

Here’s a kick: Yahoo Bookmarks drove more traffic to the asset managers in the top 100 list than LinkedIn. It's a good reminder that investors and others are using all manner of new and old tools to keep track of what's happening on your site.

Have fun checking all this out.

Note: Yesterday RIABiz named this blog one of the top 10 blogs (#9) in the advisory community. It’s a thrill to be included in such a prominent set of commentators, and it makes me want to try harder to deserve the honor. I recommend the full list of blogs—which also includes the 10 bloggers’ recommended blogs—to you.