Asset management marketing is getting increasingly sophisticated. To support that statement, I’d point to mutual fund and exchange-traded fund (ETF) firms’ heightened capture and reliance on business intelligence and analytics, integrated communications across multiple channels, the increasing mastery of non-text forms of communicating.

Segmentation, for example, is an area where firms are making strides. The more customized, even personalized a communication, the greater its relevance.

But I’m wondering where investment management marketers are on what may be the most fundamental segment of all: gender. Does your customer relationship management system (CRM) capture the gender of your contacts? Can you/do you run reports segregating male financial advisors from females to isolate differences in response and even AUM and sales?

But I’m wondering where investment management marketers are on what may be the most fundamental segment of all: gender. Does your customer relationship management system (CRM) capture the gender of your contacts? Can you/do you run reports segregating male financial advisors from females to isolate differences in response and even AUM and sales?

My experience, and my impression corroborated with a few additional pings to others in the industry, is that the overall availability of information about the gender of database contacts is spotty.

Gender is a custom field in both Salesforce and SalesPage CRMs. But while it’s relatively trivial to add, it must be identified as a requirement—and at many firms that hasn’t happened. Capturing gender data isn’t a priority for Sales, which tends to drive CRM implementations.

Granted, most of the contacts in an asset manager’s CRM are going to be male. But, according to data kasina reported in 2013, female advisors made up 17% of advisors across all intermediary channels. That's plenty of female names as well as uncommon names or names that could go either way (e.g., Pat Allen) that justify a mandatory gender field.

Learning From Social Media Analytics

The insights being gleaned from social media use are what prompt the question now. Underlying virtually every social platform is a database that’s core to its value. The networks, and third parties with access to the APIs, produce demographic analyses that can be quite helpful to understand who an account is reaching and whether content adjustments are necessary, as is often the case.

To give you an idea, here’s a Demographics Pro analysis of the @RockTheBoatMKTG Twitter account.

The content I selected to tweet over the last six years is what attracted this group to the account. Seeing this was both eye-opening and sobering. These people look like they mean business. No, I won’t be bothering them with my real-time insights about The Bachelor.

The content I selected to tweet over the last six years is what attracted this group to the account. Seeing this was both eye-opening and sobering. These people look like they mean business. No, I won’t be bothering them with my real-time insights about The Bachelor.

At the same time, analysis of aggregated usage data is resulting in reports and commentary drawing gender distinctions between what works on social networks. To wit:

- “Pinterest’s Problem: Getting Men to Commit” was the headline of a Wall Street Journal article that offered “gender differences in information processing” as one reason for Pinterest’s unpopularity with men. Studies by Joan Meyers-Levy, a marketing professor at the University of Minnesota, “have shown that women are able to process information more comprehensively and do so at a lower threshold. Men are more selective and tend to focus on the essentials…

In other words, Pinterest’s busy design may create an information overload for men. “If this was a magazine, they’d turn the page,” Ms. Meyers-Levy is quoted as saying. “It works for females because they like detail, they like more complexity.”

I read this article and then headed over to a busy, busy fund profile page. Hmmm.

- Several conclusions are being made based on differences in how social media is being used.

Women are more vocal, expressive and willing to share, reports BrandWatch in this post aggregating gender data from multiple social media survey sources. More women use Facebook and Twitter. They’re interested in making connections and staying in touch. More women than men (58% vs. 42%) consume news in social media. The data show that women are more active altogether, more active on mobile devices and more likely to follow and interact with brands.

Men, who outnumber women on LinkedIn, use social media to gather the information they need to build influence—they perform research, gather relevant contacts and ultimately increase their status.

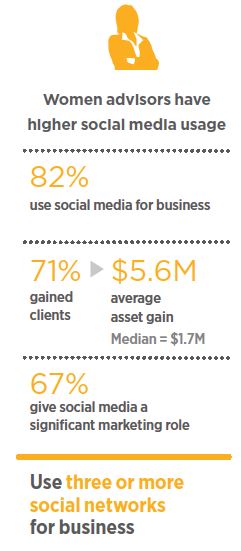

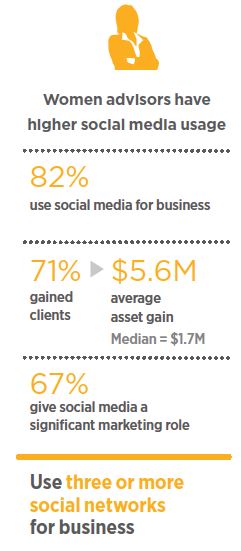

- Closer to home, Putnam’s December 2014 research on financial advisor use of social media was the first work (I believe) to report in-depth on advisor gender differences. The findings track other research, showing that women financial advisors do more but also benefit more when using social media for business. The screenshot at right is from Putnam’s infographic and shows that 71% of social media-using female advisor respondents gained clients versus 64% of male advisors. Their average asset gain of $5.6 million is more than three times the median of $1.7 million, slightly more than the average male gain of $5.5 million.

Most interesting are the gender differences between the social media content that advisors react to. According to the Putnam data, female advisors are far more likely to respond to your blogs, podcasts and slideshows.

Pursuing More Hits Than Misses (Absolutely No Pun Intended)

An irony is that financial advisors themselves are increasingly focusing on gender differences between their male and female clients—with help from a few asset managers’ value-added programs.

Most mutual fund and ETF content teams today are somewhere in between producing just what’s required (the legacy of the good old days when the time and expense of print served as a natural limiter) and churning out as much as fast as they can. As the range broadens and volume rises to take advantage of burgeoning opportunities, the chances are that there will be more misses than hits.

A better command of the demographics of the names in your database could help steer some of this. Also: Tracking such data might help mitigate the risk and/or address challenges that arise when a disproportionate number of females are involved in the process of creating fund communications directed at salespeople and users that skew largely male.

Those of you with consistent, reliable data on the male/female composition of your database have an advantage. You’re able to study and understand any response differences that may exist. You can compare the demographic reach (including gender and other dimensions) of your owned communications with your social communications. You can test whatever content adjustments seem indicated. You could plan all-male or all-female communications, I suppose, but I’d tread carefully making any assumptions there.

Sales may have limited interest in documenting a contact’s gender in the CRM because they pride themselves on knowing the top 250 producers they’re focusing on—they don't have to check to see who's a woman and who's a man! If Marketing’s charge is to better understand and nurture the interest of everybody else, isn’t gender an obvious piece of data to begin to collect and understand?