Why Your Site May Be On The Verge Of Losing Lots Of Traffic

/ TweetHere’s a quick test for you: Search for the ticker symbol of one of your firm’s funds, a big one, a small one, it doesn’t matter.

What’s the top search result? A big ole chart, right? The screenshot below shows the results of a Google search on a desktop and on a smartphone. (Incidentally, note how simple and clean the data display can be when not weighed down by the pesky disclosure that’s required on your site.)

How many searches do you suppose your site loses to Google Finance, Morningstar and Yahoo Finance, the sites linked to at the bottom of the ticker symbol graphs?

There’s no need to guess—just check your Webmaster Tools account (Search Traffic/Search Queries). You’ll likely see that your site is being displayed in search results for ticker symbol searches (Impressions) but that you’re not getting the majority of the clicks.

In all likelihood, the information that Google is providing to ticker symbol searchers right there on the search results page is either 1)satisfying the searcher or 2)driving the searchers to Google, Morningstar, Yahoo fund or (for ETF ticker searches) even MSN Money profile pages.

Ouch. This especially hurts because ticker symbol searchers are the most qualified site visitors you could ask for—no doubt you’d prefer them to come to your site, sign up for an email newsletter, ask for more information, check out other funds… Opportunity is being lost because Google (and Bing, too, by the way) siphons interest in the ticker symbols of your products and reroutes traffic.

Now, competition for organic search rankings is one thing. If the authority of your domain is lacking or if you haven’t taken the appropriate SEO steps to lift the visibility of your fund pages, well, then, you’ve had your fair chance and didn’t step up.

But this extraction of structured fund data from a third-party database is different because it’s completely beyond your ability to appeal.

The publishing of fund prices on the search results page has been going on for years. My sense is that asset management digital marketers are desensitized to the traffic/attention that’s being lost. Do you remember that parable about the frog in the water? As long as the water boils slowly, the frog won't jump out because he doesn’t perceive danger.

The Knowledge Graph And Its Impact

As it turns out, asset managers have had an early taste of what many site publishers are now experiencing due to Google’s implementation of what it calls the Knowledge Graph.

The Knowledge Graph, according to Google’s 2012 introduction of it, enhances search by narrowing search results, summarizing relevant content around a search query, and facilitating deeper and broader searches. "It currently contains more than 500 million objects, as well as more than 3.5 billion facts about and relationships between these different objects. And it’s tuned based on what people search for, and what we find out on the Web," Google wrote three years ago.

Knowledge Graph-driven search results have become more prevalent in the last year. The goal of Knowledge Graph information, whether displayed in answer boxes immediately below the search box or in a panel to the right of the search results, is to instantly provide an answer that’s relevant to a search query. Relevant answers delivered on the spot are increasingly important as more searches take place on mobile devices. The fewer clicks required on a smartphone, the better.

This is an expanded role for Google. As opposed to just directing search traffic to the most relevant Websites, it’s now taking it upon itself to try to answer search queries. For a current overview of the various search-related initiatives underway at Google (i.e., Voice Search, Knowledge Graph, Google Now), see this Medium post, part one of a series. About 25% of search queries today produce Knowledge Graph answers, according to author Steven Levy.

While fund sponsors never made a peep about Google effectively hijacking searches for ticker symbols, many Website publishers who explicitly monetize their sites are upset and confused about the rise of Knowledge Graph.

Some object to Google’s “scraping” their sites to extract a result to show in a Knowledge Graph answer box. It’s a backhanded compliment—Google thinks enough of the site to extract answers from it, but that results in a loss of visitors to revenue-producing pages.

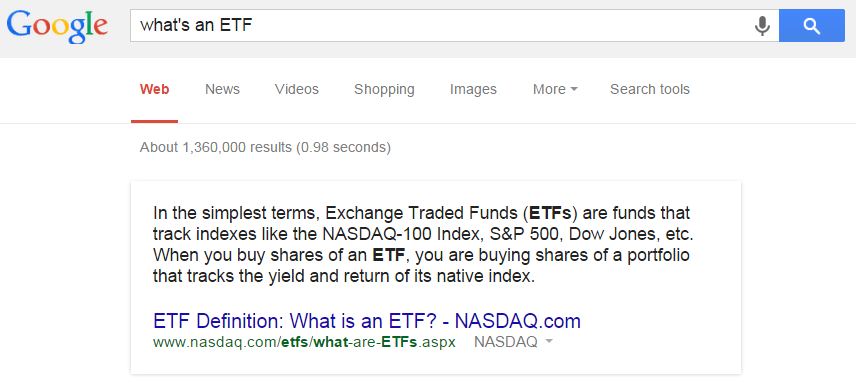

It’s easy to see the value that’s being provided to the searcher. If all a searcher wants is a basic definition of ETF, this Knowledge Graph extract from Nasdaq.com might be enough. If the searcher wants to dig further, Nasdaq is in an advantaged position to get the click from the added prominence on the search results page.

Consequently, some search engine optimization experts are pivoting into Knowledge Graph Optimization. Sources of the Knowledge Graph include Google+, Wikipedia, Freebase and Schema, which is structured markup added to Websites to clearly identify standard elements that Google may want to lift. Following the markup standard for Customer Service phone number, for example, can result in Google extracting the number and publishing it with the search results.

Knowledge Graph Optimization prepares Website content for what is effectively syndication of granular content.

But not all SEO experts or Website publishers approve of this appropriation of content. Many are product manufacturers, like fund companies, and they’re insisting that they should be able to be both the authoritative source of information and a search destination. For two perspectives, see Knowledge Graph 2.0: Now Featuring Your Knowledge and Knowledge Graph: Does it Make Sense to Optimize for the Google Scraper?

We live in interesting times.

So, where does this leave the asset management Website and Web strategy?

Next: Converting Searches For Fund Names

I remember how shocked my team and I were back in the day when we saw the first analytics that revealed that our site’s Daily NAV pages were the most popular pages. That made sense then for two reasons: 1)This predated the fund data aggregators and 2)advisors habitually used multiple funds from the same fund family—a late afternoon or evening visit to the fund sponsor’s Daily Prices page was all they needed.

The bleak future of sites that relied on single-page visits to pages whose data could be found elsewhere didn’t dawn on us until later.

Let’s turn now to your Web analytics. How much of your traffic goes to your product pages? Today, you may be missing out on ticker symbol searches, but my guess is that you’re still getting the traffic from people who are searching for your products by their names. This includes a long tail of searchers using a creative mix of how they spell, remember or type fund names.

Let’s turn now to your Web analytics. How much of your traffic goes to your product pages? Today, you may be missing out on ticker symbol searches, but my guess is that you’re still getting the traffic from people who are searching for your products by their names. This includes a long tail of searchers using a creative mix of how they spell, remember or type fund names.

Such keyword searches are increasingly giving way to semantic searches, in which Google considers user search history as well as other contextual signals. It’s just a matter of time before Google looks at those incomplete, hastily entered fund names, automatically does the translation and understands that the searcher is looking for a fund. The fund data graph will be what's displayed as the top search result for all those searches, too.

The goal is to provide information fast, remember, and displaying the graph with the table of basic return, expense and asset size data is faster/more useful than just offering links to an asset manager fund page or, God forbid, PDF of a fact sheet. The implication for your site: More traffic (opportunity) lost.

This is your risk today. I make the assumption that traffic to your domain is something you want to protect, if not build, for a multitude of reasons that start with brand awareness and lead right up to lead scoring and predictive analytics initiatives.

A Few Recommendations

Here’s what the proactive asset management digital marketing team should be doing, at a minimum:

- Use the data available from Webmaster Tools and your Web analytics to get a handle on what’s what. Make sure you understand the sources of traffic to your fund pages and their value to you. How many anonymous visitors convert to newsletter subscribers or registered advisor site users, for example? How much of the traffic that Google sends to Google Finance, Morningstar, Yahoo Finance and MSN Money finds its way back to your site—how much as a result of the editorial versus advertising?

Track all changes in your volume of search traffic and sources over time.

- Confront the obvious: Why would a fund searcher be better off coming to your site as opposed to another site?

If you’ve researched a car in the last few years, you know that there are some automobile manufacturers that deliver superior, differentiated experiences on their Websites. Car buyers who rely exclusively on an Edmunds.com or other car review site are missing something if they don’t check out the configuration capabilities and other bells and whistles offered by the manufacturers.

What information can you uniquely offer and attractively/interactively present for product tire-kickers?

By the way, I had the “So, what’s so special about the fund information that appears on your site?” conversation with someone recently, and she answered, “We’re the only source of our capital gains distributions.” Well, OK, that’s a start. Those pages command a lot of eyeballs at this time of year. And yet, very few firms use the margins of those pages to cross-market or otherwise communicate.

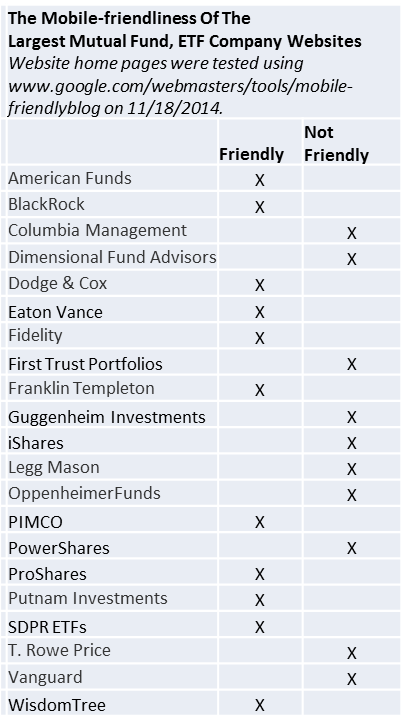

There’s no stopping Google so control what you can control—give the site visitors you attract better information and a better experience, and that includes when on a mobile device.

- If you think your site offers worthwhile, appealing features and data that deserve the attention of fund data searchers, promote it. Don’t sit back and expect site visitors to find it.

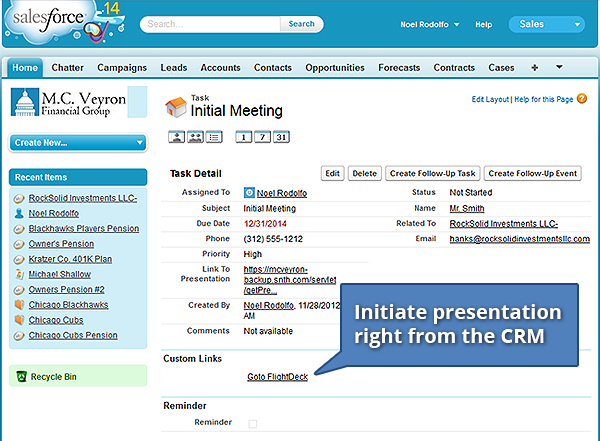

Make sure your wholesalers are versed on the depth of the fund data available on the site. Promote it on the home page, throughout the site and consider targeted pay-per-click ads. As of now, you can still buy your way to the top of the ticker symbol search.

As Google gets more grabby to protect its own value proposition, you need to be more aggressive, too.

As Google gets more grabby to protect its own value proposition, you need to be more aggressive, too.

- Finally, if you can’t fight them and win, join them. Google’s evolution of the Knowledge Graph (whose answers are extracted from only the first page of search results) gives you just one more reason to commit to publishing authoritative mobile-friendly content that’s optimized for search.

Your thoughts?